When you start your own business venture, you know you are going to struggle for a few years. Struggle for stability, struggle for recognition and not to forget, finance. How do you get someone to finance you and your hard work? WHO do you approach for a chance to prove yourself and get the necessary dough to build your dream and watch it take off? Here are the 6 most popular sources of financing for startups:

1) Personal investment:

More than often, you are going to end up investing in your own venture to kick start it. But there might be chances that you aren’t financially stable enough to keep investing for a long time. This shows that you are confident about what you have started and have a long term commitment towards it.

2) Friends and family:

This is the investment made by your friends family and others which will be repaid once the business starts earning some profits.

3) Angel investors:

Angels are generally wealthy individuals or retired company executives who invest directly in small firms owned by others. They are often leaders in their own field who not only contribute their experience and network of contacts but also their technical and/or management knowledge. They generally invest in businesses that are in their early stages ranging from $25,000 to $100,000.

In return, they reserve the right to have a say in the company’s management process.

4) Venture capital:

Venture capitals generally look for technology driven business which have high growth potential in sectors like tech, communication and biotech.

Venture capitalists generally take a share in the equity of the company and often expect heavy returns on their investments.

5) Bank loans:

These are the most common sources of funding for small and medium sized businesses. You should know that every bank out there offers different advantages, so it is advised to do your homework and find a bank that meets your needs as much as possible. In general, you should know bankers are looking for companies with a sound track record and that have excellent credit scores. A good idea is not enough; it has to be backed up with a solid business plan.

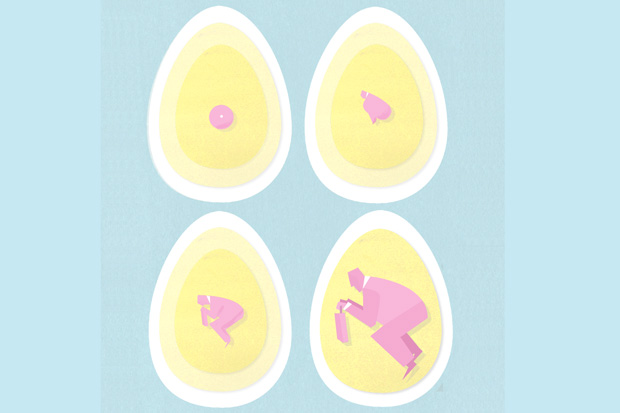

6) Business incubators:

Business incubators generally focus on the high-tech sector by providing support for new businesses in various stages of development. Commonly, incubators invite future businesses and other fledgling companies to share their premises, as well as their administrative, logistical, and technical resources.

Generally, the incubation phase can last up to 2 years. Once the product is ready, the business usually leaves the incubator’s premises to enter its industrial production phase and is on its own.

These are a few of the sources that we came across while doing our homework. If you have anymore in mind do let us know!

We are going like really soon. Check us out at www.pipesapp.com! Stay tuned for more!